Contents

Provide specific pound sterling to quant gbp to you, such as portfolio management or data aggregation. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Expert market commentary delivered right to your inbox, for free.

- I understand that I will be billed $1,794 annually if I choose to continue.

- In addition to tracking price, volume and market capitalisation, CoinGecko tracks community growth, open-source code development, major events and on-chain metrics.

- Here is it as well as other useful data about this kind of cryptocurrency.

- The growth was almost vertical in December, as the Raiblocks market cap surpassed $1 billion for the first time and XRB zoomed past $1 and $10.

This was about 39% of the original max supply but the rest was burned. The limited supply makes NANO a scarce asset, like Bitcoin, and so potentially a good store of value in the long term. As the circulating supply will always remain constant, any increase in demand for NANO will lead to a rise in price. The sudden crash in May 2021 was also market-wide, affecting every single major cryptocurrency.

Nano price history can be analyzed with many of the same techniques as the stock market. Technical analysis involves using various indicators while studying price charts in order to make sense of previous price movements. With NANO, as with many other tradable assets, large price swings are often accompanied by spikes in trading volume, as a large number of users buy or sell their coins on exchanges. The values of cryptocurrencies fluctuate constantly in response to supply and demand. Our crypto currency converter tool has the latest Euro to Nano conversion rates no matter how frequently the prices change. We partner with the most popular currency and cryptocurrency data providers worldwide to bring you the most recent quotes for all major cryptocurrencies.

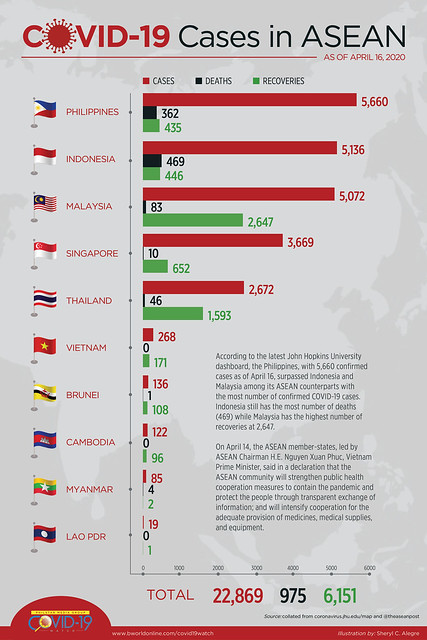

NANO’s huge single-day drop in March 2020 came as economies and borders were closing down around the world in response to the COVID-19 pandemic. The effect of this was felt by the whole cryptocurrency sector and the entire stock market, which experienced the biggest single-day crash since 1987. Rainbow is currently ranked as the #8094 cryptocurrency by market cap. If you are looking to buy or sell xrb, PancakeSwap is currently the most active exchange. This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service.

Nano Guides

However, new commercial partnerships and ecosystem projects in the future could promote broader adoption of NANO and drive demand for it, thereby raising its price. This demand will likely grow as the network expands and gains more users. Activities that drive broader adoption, such as more commercial partnerships, ecosystem development, and community engagement, could therefore boost NANO price. Described as “digital money for the modern world”, Nano is a peer-to-peer platform for the efficient transfer of value.

The Barchart Technical Opinion rating is a 24% Sell with a Weakening short term outlook on maintaining the current direction. Live educational sessions using site features to explore today’s markets. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile.

Intraday data delayed at least 15 minutes or per exchange requirements. The dividend yield measures the ratio of dividends paid / share price. Companies with a higher dividend yield tend to have a business model that allows them to pay out more dividends from net income like real estate and consumer defensive stocks. Companies that pay dividends tend to have consistent positive net income. The first week of January 2021 saw prices surge to about $5.50, before consolidating for the rest of the month.

What is the market sentiment of Nano today?

The cryptocurrency hit a peak of over $8 in February, but shed half its value a few days later. The rally didn’t resume until the end of March, bringing NANO to a high above $15 in April. This was followed by a more than 60% pullback, before another burst of bullish momentum resulted in a peak of $18.58. Then came another retracement and prices dipped below $4.60 during a crash of more than 50% within a single day in May. Although NANO rebounded to almost $10 at the start of June, it then went into decline again, dropping to under $4 later in the month. XRB.TO stock price is 22.83 and iShares Canadian Real Return Bond ETF 200-day simple moving average is 23.47, creating a Sell signal.

For US and Canadian Stocks, the Overview page includes key statistics on the stock’s fundamentals, with a link to see more. Barchart is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve our web experience, and encourage users to Contact Us for feedback and accommodation requests. Long term indicators fully support a continuation of the trend.

iShares Canadian Real Return Bond ETF Share Price Forecast

CoinGecko provides a fundamental analysis of the crypto market. In addition to tracking price, volume and market capitalisation, CoinGecko tracks community growth, open-source code development, major events and on-chain metrics. Broader market trends have also played a role in NANO’s price history. Its surges at the end of 2017 and start of 2021 weren’t unique – the entire crypto market pumped around these times. Bitcoin was in the midst of major bull runs then, and with such strong market dominance, any significant price movement for Bitcoin often impacts other cryptocurrencies.

Various contributing factors have been suggested, including comments made by Elon Musk, a crackdown by Chinese authorities, liquidations, and a healthy market correction. The data on the price of Rainbow and other related information presented on this website is obtained automatically from open sources therefore we cannot warrant its accuracy. COINCOST is in no way related to the cryptocurrency Rainbow, its developers and representatives. Investment Strategy XRB seeks to provide income by replicating, to the extent possible, the performance of the FTSE Canada Real Return Bond Index, net of expenses.

They had begun to fall again by June and the rest of the year took on a more bearish trajectory. As 2019 finished, https://coinbreakingnews.info/ had a price of $0.65, having decreased by 27% since the start of the year. Our nationally known presenters are dedicated to providing the finest quality seminars using standards-based content. Presenters are selected based on their expertise, excellence in classroom teaching, motivational skills, and ability to help you improve your teaching!

XRB to the moon World of WarCraft team net worth is $ prize money from WoW tournaments. CoinGecko’s Guide to Consensus Algorithms In Part 2 of CoinGecko’s guide to cryptocurrencies consensus algorithms, we look at DAG, PBFT, FBA, and PoET. For more details, please refer to Clause 12.2 of our privacy policy and Clause 5.2 in our terms of use. The community is bullish as more than 100% of users are feeling good about Nano today.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Get the latest crypto news, updates, and reports by subscribing to our free newsletter. Increase from one day ago and signalling a recent rise in market activity. This service is created to help people convert their currencies and track the dynamics of currency changes.

Market cap is measured by multiplying token price with the circulating supply of XNO tokens . The Euro to Nano historical chart shows the value of EUR relative to XRB over a specified time period. You can select the preferred time period and the chart plots the value of the currency over this range. The X-axis on the chart denotes time, while the Y-axis represents the value of Nano relative to Euros. Our money converter uses the average data from International Currency Rates. It’s impossible to make price predictions with any kind of absolute certainty, as a whole host of different factors could play a role in determining the future value of NANO.

Needs to review the security of your connection before proceeding. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Verify your identity, personalize the content you receive, or create and administer your account.

Its price has changed dramatically throughout its history and if you want to know why then you’re in the right place. We’ve compiled everything you need in order to get a better understanding of NANO price – as well as the factors which influence it. According to simple moving average, exponential moving average, oscillators, and other technical indicators, iShares Canadian Real Return Bond ETF is overvalued. The current iShares Canadian Real Return Bond ETF [XRB.TO] share price is $22.83. The Score for XRB.TO is 12, which is 76% below its historic median score of 50, and infers higher risk than normal.

IShares Canadian Real Return Bond ETF 50-day simple moving average is 23.45 while XRB.TO share price is 22.83, making it a Sell technically. Exchange-rates.org is a currency and cryptocurrency converter tool and data provider used by millions of people across the globe every month. We’ve been featured in some of the most reputable financial publications in the world, including Business Insider, Investopedia and Coindesk. IShares Canadian Real Return Bond ETF 50-day exponential moving average is 23.26 while XRB.TO share price is 22.83, making it a Sell technically. IShares Canadian Real Return Bond ETF share price is 22.83 while XRB.TO 8-day simple moving average is 23.06, which is a Sell signal. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.